Non-owner insurance just applies if you do not have accessibility to a vehicle within your home. If your roomie has an automobile, a non-owner plan might not be offered (underinsured). Rather, you could require to be listed on your roomie's automobile insurance, and their insurer would release the SR-22 for you.

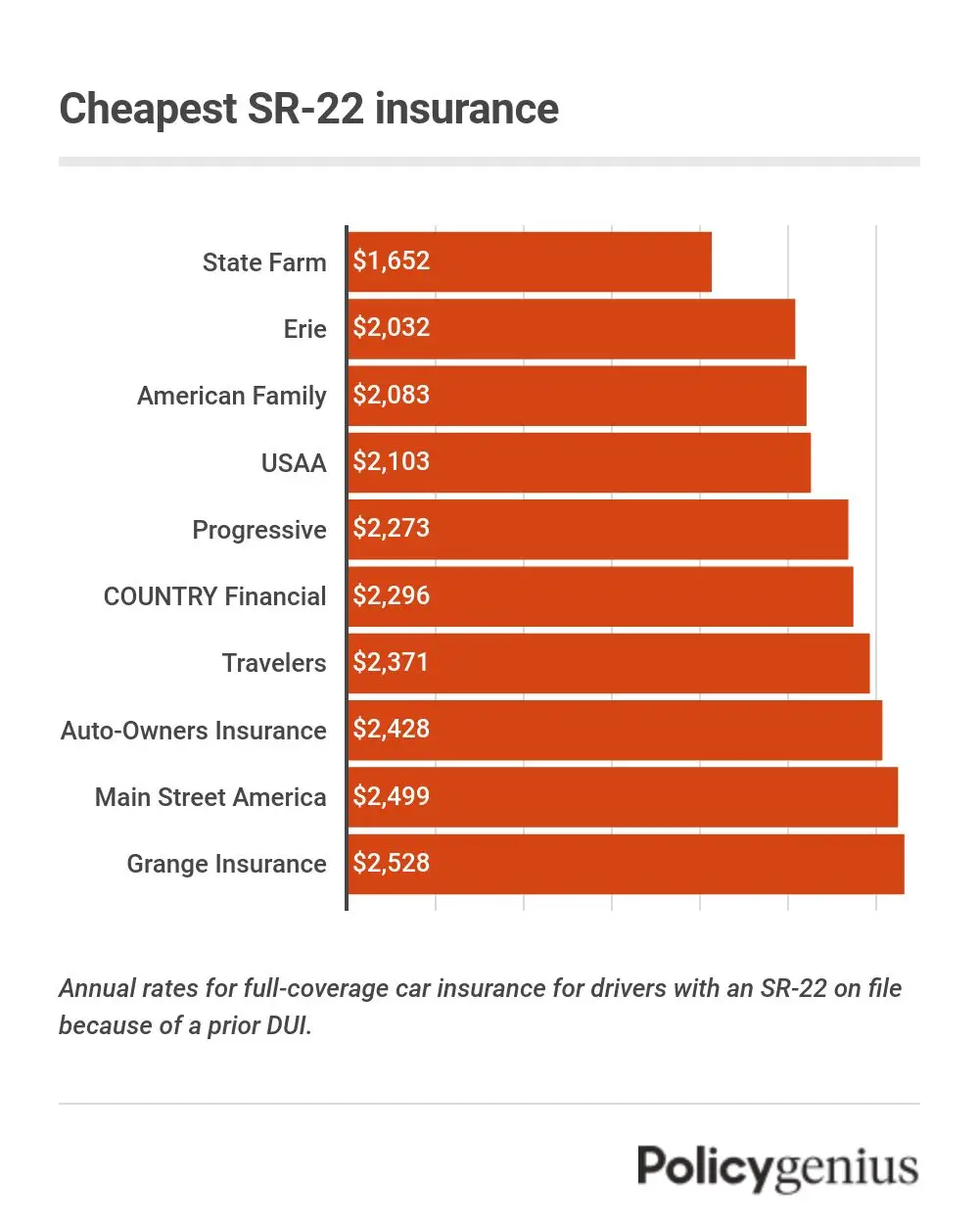

As soon as you acquire a lorry, you would certainly then alter your insurance coverage to a typical auto insurance coverage. Your automobile insurance coverage will be a lot more costly if you need to have SR-22 insurance policy in The golden state. This is not because the SR-22 kind costs a whole lot of money. There's usually a declaring cost of around $25 to obtain it sent out to the state. sr22 insurance.

A lot of insurer maintain the surcharge on your plan for three years (insurance). As soon as you struck the three-year mark, the surcharge will certainly "drop off" and not be charged for anymore at the next insurance policy renewal. This leads to a decline in your insurance policy rates as long as you do not have other tickets or task included.

Talk with your insurance provider about just how these costs are managed to make sure that you recognize what to anticipate - sr22 coverage. It's clear that someone with lots of tickets or accidents is a more high-risk driver than a person without that task. Therefore, having to obtain an SR-22 will possibly relocate you right into a higher-risk category than you were in before.

That creates every one of your insurance coverage prices to be higher, also without the direct surcharge that originates from the activity itself. Your threat group usually lasts five years, however a DUI can impact your threat for ten years - insurance coverage. That's why SR-22 insurance policy can be much more pricey long after the SR-22 is no more needed as well as the drunk driving has actually diminished the direct surcharge listing - car insurance.

The 8-Minute Rule for California Sr-22 Insurance: What It Is And How Much It Costs

When it falls off, you can retake the class to restore the deal (insurance group). Numerous insurance companies supply a lot more than simply auto insurance policy, such as property owners as well as renters coverage (liability insurance). When you carry both your car as well as house policies with one company, you may receive a multi-policy discount that lowers the costs on both kinds of insurance coverage.

A lot of insurers use a multi-car price cut if you have more than one automobile with them. Having numerous cars on one plan is usually cheaper than having an individual policy on each one, so be certain to ask for a quote. underinsured. Insurance companies constantly want you to have ideal insurance policy coverage, but in some cases changing the sorts of protection on your vehicle can make a huge difference.

If you wish to continue with extensive and also crash protection, why not see just how much you can conserve with a greater deductible? Often transforming the insurance deductible can conserve you a great deal of cash every month - vehicle insurance. A safer auto is more affordable to insure, so ensure you allow your insurance provider find out about all the safety and security tools you have actually mounted (no-fault insurance).

Can being a member of the army, an expert, or holding certain subscriptions. Make certain you speak to your insurance company concerning all of your affiliations so they can apply all the price cuts you are worthy of.

Having a DUI or significant driving conviction is irritating, and returning on the roadway is a lengthy process (insurance coverage). However, we're right here to help. We don't evaluate anybody since of their background; we want to help you obtain the insurance coverage you require so you can obtain back to driving securely.

All about How Much Does Sr22 Insurance Costs

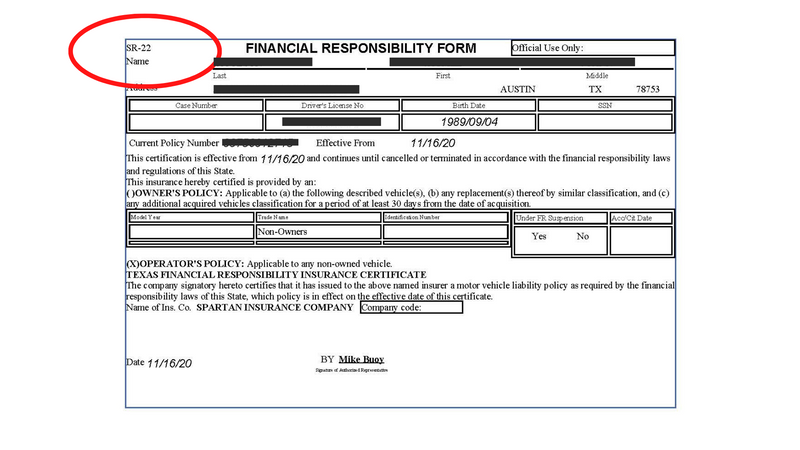

Texas SR22 Insurance Questions as well as Responses The state of Texas calls for an SR22 declaring if you have been driving without insurance policy or other infractions such as driving drunk of alcohol. The Texas SR22 kind is compulsory for 2 years from the date of conviction. coverage. Suppose I Do not Possess a Cars And Truck, Can I Still Get an SR22? Yes, if you don't have an automobile you can still get a Texas Non-Owner SR22 plan.

I Allowed My SR22 Insurance Coverage Gap. If you have terminated your automobile insurance plan with the SR-22 form the state will be informed promptly by the insurance coverage business (auto insurance).

Texas SR22 Insurance Requirements When you file SR22 insurance coverage in Texas the state calls for that the minimal liability limitations be in force on the policy for 2 years (insurance coverage). The minimal liability insurance coverage limitations are: $30k Each Physical Injury $60k Per Accident Bodily Injury $25k Residential Property Damages While these limits are minimal they are seldom advised levels of protection - insurance group.

02 or higher CDL chauffeurs = BAC. Your vehicle drivers permit will be suspended for a minimum of 90 days however no even more than 1 year.