What is an SR-22? An SR-22 is a certificate of economic duty required for some drivers by their state or court order. An SR-22 is not a real "kind" of insurance policy, however a kind submitted with your state. This kind serves as proof your auto insurance plan satisfies the minimum responsibility protection called for by state law.

Do I need an SR-22/ FR-44?: DUI convictions Negligent driving Mishaps created by uninsured motorists If you require an SR-22/ FR-44, the courts or your state Motor Car Department will notify you.

Is there a fee linked with an SR-22/ FR-44? This is a single cost you need to pay when we file the SR-22/ FR-44.

A declaring cost is billed for each and every specific SR-22/ FR-44 we file. As an example, if your spouse is on your plan and also both of you require an SR-22/ FR-44, then the declaring cost will be charged two times. Please note: The charge is not consisted of in the price quote since the declaring cost can differ.

Your SR-22/ FR-44 ought to be legitimate as long as your insurance policy is active. If your insurance coverage policy is terminated while you're still needed to carry an SR-22/ FR-44, we are called for to alert the proper state authorities.

Sr22 Insurance And How It Works - Dairyland® Auto - Truths

If you wish to submit the type yourself, you'll require to initial ask your insurer for the certificate. Once the fees are paid as well as SR-22 papers sent in, you can examine your chauffeur qualification standing online through the Texas DPS website. Your standing will certainly be updated to "qualified" from "ineligible" after your papers have actually been processed.

If there are any adjustments to your license status, the DPS will inform you by mail, so ensure it has your present mailing address on data. How a lot does SR-22 insurance expense in Texas? An SR-22 insurance coverage will set you back greater than your previous protection, mostly because of whatever violations created you to require an SR-22 filing.

From our list of service providers, USAA provides the lowest ordinary price of. The table below contrasts auto insurance estimates for a 30-year-old man without SR-22 insurance coverage against a 30-year-old male with SR-22 protection and a DUI (driving under the impact) cost, together with the exceptional boost in prices for each and every insurer. sr22.

There are some that you can only receive based on your lorry or driving document, yet others, such as defensive driver program discounts, you can obtain by completing some easy steps. credit score. What is SR-22 insurance coverage in Texas? If you have actually been founded guilty of certain moving infractions in Texas, such as driving intoxicated, or you have devoted way too many web traffic offenses within a duration of time, the state may require you to file an with the Texas DPS.

Non-owner SR-22 insurance policy in Texas If you need an SR-22 filing to restore your certificate, however you don't have an automobile signed up in your name, you can get a to meet the state's demand. Non-owner SR-22 insurance policy in Texas provides responsibility protection that fulfills the state's needs as well as offers coverage whenever you drive a car coming from another person.

Some Known Incorrect Statements About Pennsylvania Sr-22 Insurance

Some people need to file an SR-22 insurance policy kind after certain types of driving violations. If you have actually heard the term SR-22 insurance policy as well as are wondering what it is and also if you need it, here's what you need to recognize.

But not every person who has a license needs to submit an SR-22. Generally, a court or the state just needs individuals that have serious driving infractions, such as careless driving or a DUI, to submit the form. If you have actually a put on hold permit, your insurance provider may require to file an SR-22 kind on your behalf prior to the state restores it.

If a court or the state needs you to submit an SR-22 or FR-44 form, your insurance policy service provider will certainly submit it on your behalf. You can't get one without insurance policy. Not all insurance firms submit these types for their insurance holders - insurance companies. If your existing insurer does not submit them and you're required to have one, you'll require to obtain a brand-new policy.

Some insurance business might file an SR-22 or FR-44 for totally free, while others might charge a declaring fee. The declaring fee usually varies from $15 to $50, depending on the insurance company and also where you live.

In basic, if you require to file an SR-22 or FR-44 type, it will most likely requirement to stay in place for three years. The exact quantity of time might differ based on the driving infraction as well as state where you live.

Guide To Sr22 Insurance In Idaho [What You Need To Know] Things To Know Before You Get This

You'll pay greater car insurance premiums than a driver with a clean document and you'll be limited in your choice of insurance firms. See what you can save on vehicle insurance coverage, Quickly compare personalized rates to see exactly how much switching vehicle insurance might conserve you.

You could be needed to have an SR-22 if: You've been convicted of DUI, DWI or an additional serious relocating violation. You have actually triggered a mishap while driving without insurance policy. underinsured.

For particular convictions in Florida and also Virginia, you may be bought to submit a similar type called an FR-44. This calls for a greater level of responsibility coverage than the state's minimum. Not all states need an SR-22 or FR-44. If you require one, you'll discover out from your state division of motor automobiles or traffic court.

When you're informed you need an SR-22, begin by calling your automobile insurance provider. Some insurers don't supply this solution, so you might need to shop for a firm that does. If you do not already have vehicle insurance, you'll probably require to buy a policy so as to get your driving privileges restored.

Insurance coverage quotes will also differ depending on what vehicle insurance policy business you choose. See what you can conserve on auto insurance, Quickly contrast customized prices to see how much changing cars and truck insurance coverage could save you.

The 8-Second Trick For Sr22 Insurance Indiana - Sr-22 Form

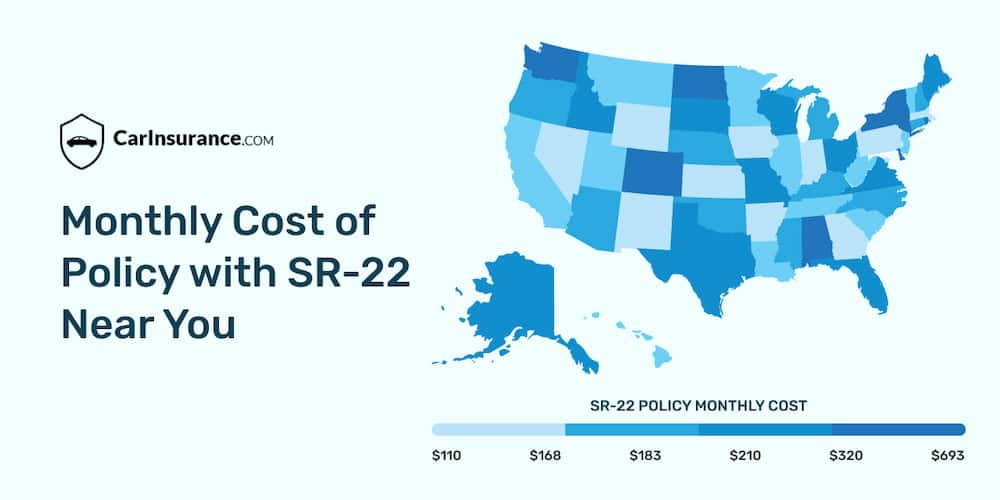

Place matters (deductibles). As an instance, take into consideration a vehicle driver with a recent DUI, an infraction that may result in an SR-22 demand. Geek, Budget's 2021 price analysis found that out of the country's four biggest firms that all submit an SR-22, insurance policy prices typically were cheapest from Progressive for 40-year-old chauffeurs with a recent drunk driving.

When your need ends, the SR-22 does not automatically drop off your insurance plan. Make certain to allow your insurance coverage firm recognize you no longer need it.

Fees usually stay high for 3 to 5 years after you have actually caused a mishap or had a relocating offense (insure). If you search following the 3- and also five-year marks, you may locate lower costs.

To help educate you, we have actually detailed exactly how SR-22 insurance coverage functions. What SR-22 Insurance Is as well as What It Covers Likewise understood as a Certification of Financial Responsibility, SR-22 insurance coverage technically isn't a kind of insurance protection.

It additionally replaces a financial deposit or a deposit slip for vehicle driver's certificate reinstatement in some states. It's important to understand beforehand that you can not personally file for SR-22 insurance coverage. You apply and also pay for it via your car insurance policy company, and afterwards that business offers you with coverage.

The Single Strategy To Use For Sr-22 Car Insurance

Who Needs SR-22 Insurance policy A lot of individuals associate SR-22 insurance coverage with Drunk drivings due to the fact that the insurance is an essential component of the chauffeur's license reinstatement process after a DUI conviction. auto insurance. SR-22 insurance policy likewise covers people who obtain caught driving without insurance, without a driver's permit, with a suspended or withdrawed certificate, or with a number of website traffic offenses in a brief duration of time.

Many people require to get SR-22 insurance coverage for 2 to five years. What SR-22 Insurance coverage Costs SR-22 insurance will certainly be an extra cost to your car insurance. You'll pay a single handling cost to obtain it. After you have SR-22 insurance policy, you'll pay a greater month-to-month premium. auto insurance. does not trigger your costs to increase.

For more details about SR-22 insurance coverage, contact us today at - insurance coverage.

An SR-22 is not an insurance plan. Instead, it is an addendum to an insurance coverage that is needed of some vehicle drivers by law as an outcome of a DUI or various other driving-related issue that notes you as a high danger - sr22 insurance. The actual details behind the SR-22, including the prices, exactly how long it needs to stay in impact and also why it have to belong of your plan will vary from one state to another.

It is a way of showing that you have the monetary coverage on your plan to spend for the people that you can potentially injure based upon your previous driving experience. Vehicle driver's licenses are suspended on a daily basis for a variety of reasons. In order for you to obtain your driving privileges reinstated, it will certainly often call for making a look in a court to plead your case (driver's license).

The smart Trick of Personal Injury Claims Against Drivers With Sr-22 Insurance ... That Nobody is Talking About

This information will be filed into a computer system, which implies that changing to an additional state so as to get another state's driver's certificate will certainly also be impossible. Acquiring the SR-22 Certificate Once an SR-22 is needed, you will need to speak to an insurance provider in order for them to issue you the certification (ignition interlock).

Not all insurer will certainly issue an SR-22, so it might call for a little research study. insurance companies. The National Organization of Insurance coverage Commissioners, found at will certainly aid in aiding you to discover a qualified representative or broker in your specific state so that you have the ability to get the SR22 insurance coverage that you need.

It will then be sent to the Assistant of the State. insurance companies. This process can take as long as one month to finish. Up until the certification is in fact finished, it will not be possible for you to restore your driving benefits since your certificate is still practically put on hold within the computer system.

It has to continue to be active and also remain in your auto at all times should you ever be drawn over and require to show it to a police. Should your insurance every gap or be canceled, your insurance firm will be called for by law to inform the DMV that you are no much longer according to the regulation.

In order to stop suspension or be within violation of the terms of the SR22 insurance laws, it is best to restore your insurance policy at least 15 days prior to the expiry day of the insurance coverage policy. It is additionally feasible that an insurer will select not to renew your plan based upon numerous variables, including driving history as well as other such info.