This protection will give tranquility of mind if you obtain a car from a pal or family member. It additionally covers incidents that take place in a rental automobile. Money, Geek reports that non-owner SR-22 insurance coverage sets you back approximately $387 per year in Iowa - credit score. The company located the most affordable policies from GEICO at $259 annually as well as State Farm with an average expense of $162 per year.

Insurance policy suppliers likewise take into consideration: Because younger and also more unskilled chauffeurs have a higher analytical price of crashes, auto insurer bill even more to make up for this greater threat - sr22. Motorists generally begin to see costs decrease around age 25. auto insurance. Vehicle insurance coverage companies correlate a high threat of cases with a lower-than-average credit report.

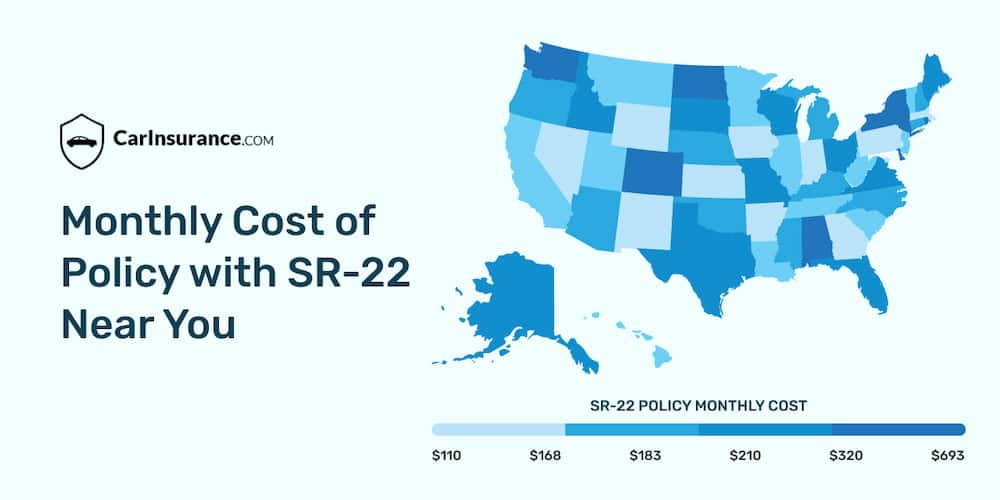

If you desire full coverage instead of minimum insurance coverage, greater protection restrictions, or other add-ons, you will pay more for those alternatives - sr-22. Just How Can You Save Money on Iowa Insurance? Comparing quotes from numerous companies is one of the most effective methods to save cash on car insurance in Iowa. Every company has its own approach of calculating prices, which means you might see considerable premium distinctions from one quote to the next, even if you lug SR-22 insurance.

If your SR22 vehicle insurance plan is terminated, gaps or ends, your vehicle insurance provider is called for to notify the authorities in your state. (They do this by releasing an SR26 type, which accredits the cancellation of the policy. auto insurance.) At that point, your license could be put on hold again or the state may take various other significant activities that will certainly restrict your ability to drive - credit score.

State laws regarding SR22 car insurance requirements can be made complex. That's why it's so important to get reliable info and support from accredited insurance agents at respectable SR22 insurance coverage companies. liability insurance.

And also, experienced agents will certainly be able to aid you discover an accepted affordable SR22 insurance coverage policy - insurance.

Getting My Sr-22 Insurance: Compare Quotes And Find Cheap Coverage To Work

It is always excellent to understand that SR22 is not such as regular vehicle insurance. As an outcome not every automobile insurance coverage business is able to aid you with SR22.

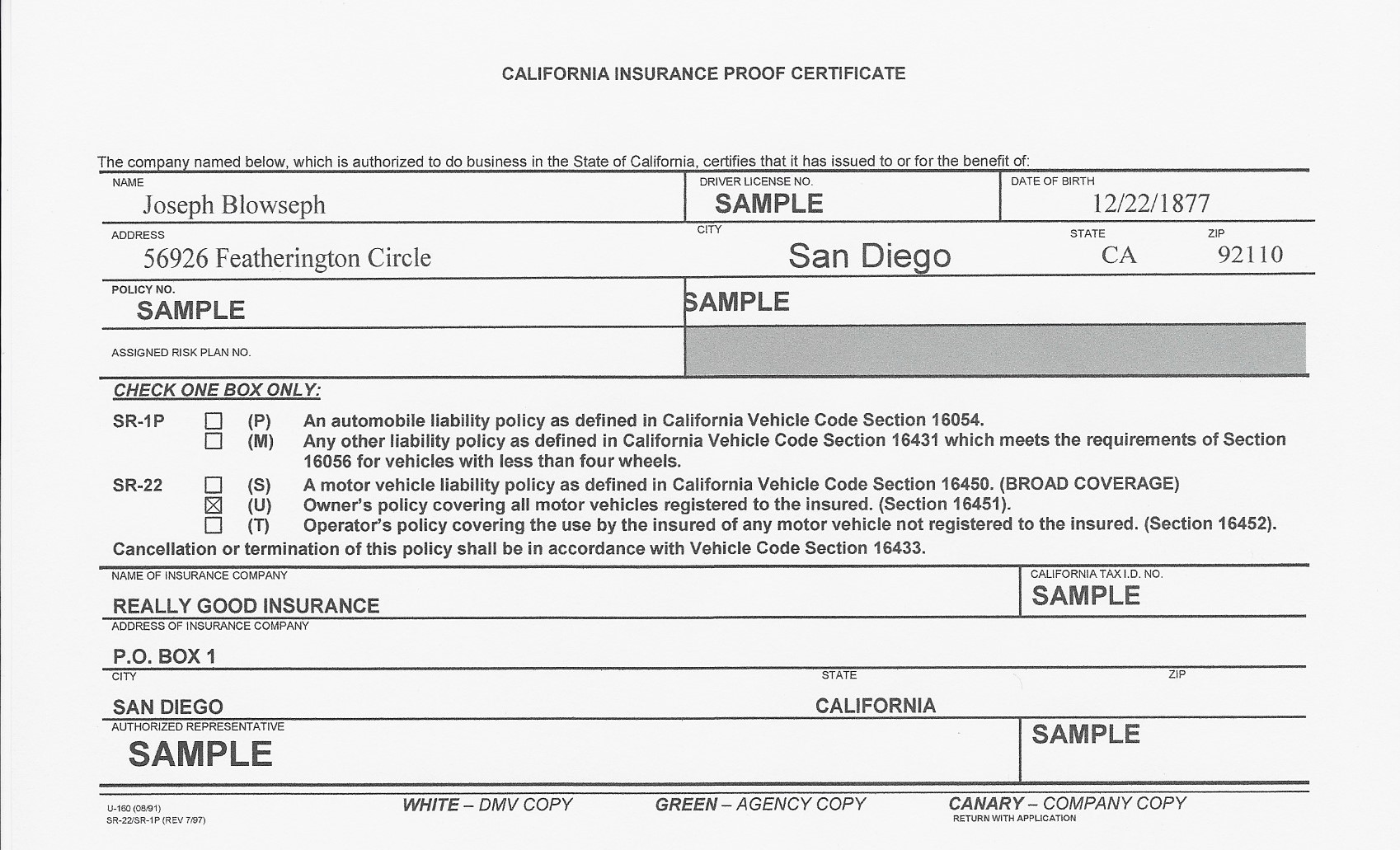

We ensure that all policies are appropriately filed as well as kept. The most usual reason for SR22 insurance in The golden state is to reinstate vehicle driver's certificate. Nowadays an auto is a part of our lives. Life can come to be a nightmare without having legal capability to drive. Below is a complete checklist of reasons for SR22 demand in California: DUI (Driving intoxicated of alcohol) DWI (Driving while intoxicated) Caught on driving without car insurance policy. vehicle insurance.

In The golden state SR22 insurance policy is mandated for 3 year period. In situation you fall short to keep your plan you will be called for to begin over - vehicle insurance.

As an outcome, the last cost will be readjusted according to your driving background. Your age young chauffeurs under age of 25 have greater expenses for insurance premiums. insurance coverage.

They are a lot more responsible than those who are presently solitary. To put it simply, married individual will certainly more than likely improve prices after that unmarried with same account. credit score. Gender based on criminal statistics throughout the US, males are more probable to go against web traffic laws - insurance. That is why males will certainly have a little higher prices on insurance.

Credit score Rating bad history with banks can result in higher insurance policy prices. SR22 is all about the capacity to preserve your insurance policy condition throughout necessary period.

The Basic Principles Of What Is Sr22 Insurance? - The Balance

Select Insurance policy Team is qualified to offer rates also less after that $15/month. This results from the truth that we go shopping numerous sources to provide affordable prices to our consumers. Pretty often we have price cut programs. The ideal method to examine if you are qualified is to fill out our quote type - sr22 coverage.

When approved you will receive a letter from the DMV mentioning they have gotten your car insurance policy with form SR22. Maintain this insurance for a minimum of 3 years or your court-ordered suspension period. insurance group. Do not allow this plan gap as your license will be suspended again as well as the duration will certainly begin over - no-fault insurance.