Those that call for a paper filing can take a few days to complete. Just how will an SR22 affect the expense of my insurance policy? While the declaring charge for the SR22 is reduced or no-cost, with the mandate. This occurs since drivers that are called for to have an SR22 are considered high-risk by insurance business.

It is very important to remember that you will be accountable for the price of your deductible if you are involved in a mishap so always select a deductible that you can afford. Another way to reduce the premium cost is to take into consideration the kind of car you drive (vehicle insurance). High-end and cars have a tendency to be much more pricey than sedans as well as other vehicles with high safety rankings.

Some insurance policy firms use specific discounts on premiums so talk to your representative and find out for what you may certify.

"People that are needed to have this evidence are motorists that have some conviction or infraction with their state," claims Teresa Scharn, vice head of state of personal lines product advancement at Nationwide. "They might have a DRUNK DRIVING, they might have been founded guilty of negligent driving, [or] they might have been convicted of driving without insurance policy." Renewing or maintaining your chauffeur's certificate is contingent on filing an SR-22.

Typically, you'll need an SR-22 form in the adhering to conditions: You have actually been founded guilty for driving under the influence (DUI) or driving while intoxicated (DWI)You remained in an accident you triggered, while driving without insurance, You drove while your license was suspended or withdrawed, You've obtained also numerous driving tickets in a short period of time, You really did not pay court-ordered child support, Maintain in mind that not all states need an SR-22, and some call for an FR-22 (a similar kind requiring you to bring even more obligation coverage than the state minimum) for sure offenses - deductibles.

The smart Trick of Sr-22 And Auto Insurance After A Dui/dwi/owi Arrest That Nobody is Talking About

If an individual does not renew the SR-22, "then the insurance coverage company is called for to tell the state they have failed to meet the SR-22 declaring need, implying they're driving without insurance coverage," states Scharn - underinsured. The expense of an SR-22 will vary by state, however you 'd commonly be billed $25 by your state DMV.

What to Do When Your SR-22 Ends, So you have actually been driving safely and also paying your insurance costs on schedule for three years (or whatever the SR-22 period is for your state). "When you satisfy the time demand, your SR-22 condition is lifted," Chen claims. From right here, you can let your vehicle insurance provider understand the SR-22 type isn't needed, because otherwise they'll continue sending it to the DMV."After 3 years, normally several of those sentences diminish your driving background, and also your rates have a tendency to go down if you haven't had any even more crashes or violations," states Scharn.

Lots of insurance provider will certainly reduce you a much better bargain after you have actually demonstrated a good driving history 3 to 5 years after the violation - no-fault insurance.

motor vehicle safety deductibles dui driver's license no-fault insurance

motor vehicle safety deductibles dui driver's license no-fault insurance

At United Automobile Insurance Coverage, we know that being told you need an SR-22 can feel stressful, confusing and also like you are the just one who requires this extra certification (underinsured). The good news is for you, we can assist with all of those problems and you need to know that needing an SR-22 is much more typical than you assume.

Responsible Crashes, Depending on the seriousness of a mishap, if you have been found liable for a crash, you might likewise be ordered by the courts to keep an SR-22 for a collection period of time. Multiple Violations, Those who acquire multiple smaller traffic offenses in a brief time period might need to file an SR22.

Some Known Details About What Does A Sr22 Insurance Cover? Chicago Sr22 - Urban ...

Exactly How Does SR-22 Insurance function? You may have problems if your company is not licensed in the state requesting an SR-22 certification - insurance coverage.

Living in a various state does not suggest your SR-22 demands vanish. If your insurance provider is not certified in the state requesting the SR-22, you will need to directly send the SR-22 kind keeping that state's DMV.If the process is overwhelming, call the state's Division of Motor Automobiles or your representative for support on your state's needs - insurance companies.

SR22 Insurance Coverage Expenses, Exactly how much an SR-22 declaring prices varies by state - auto insurance. Vehicle driver's usually pay around a $25 declaring cost for declaring SR-22 insurance https://washington-oregon-sr-22-insurance-quotes.us-east-1.linodeobjects.com/index.html policy.

Satisfying your state's requirements need to be a top priority, yet you desire to find a quote with a policy that is cost effective. Will an SR-22 policy impact my insurance policy price?

Constantly be prepared for greater protection rates after the filing (dui). How to Lower Cars And Truck Insurance Fees After an SR-22 plan, Your cars and truck insurance coverage premiums are bound to enhance following an SR-22 need and you're going to desire to discover a way to lower them. While they may never ever be as low as they were pre-SR-22, there are still some methods to make them match your budget better.

The Facts About Sr-22 Insurance: What It Is And When It's Required - Nolo Revealed

liability insurance sr22 insurance vehicle insurance sr22 insurance division of motor vehicles

liability insurance sr22 insurance vehicle insurance sr22 insurance division of motor vehicles

The greater your insurance deductible is, the much less your insurance premiums will be. It is essential to bear in mind that once you establish your deductibles at a certain quantity, you require to make certain that you can really pay it adhering to a collision.

It's useful to shop around and also profession in your car for one that's a pair of years old with good safety rankings. You will certainly show up to be much less of an insurability risk to your insurance provider.

If you are still displeased with your insurance policy premiums, ask your insurance agent about any discount rates you are qualified for. Agents are well notified of the essentials of all sort of discounts you can get. Terminating or Eliminating Your SR-22 Protection, Also if you are particular your SR-22 duration is up, calling your states Division of Motor Automobiles or DMV verifying that is an excellent idea.

Carrying only the state minimum coverage will commonly not suffice when you need an FR-44. This, consequently, will elevate your car insurance rates (insurance companies). An FR-44 certificate is needed for 3 years on standard, and also it likewise can not be terminated prior to the expiry date. SR-22 Frequently Asked Questions, Exist various sorts of SR-22s? There are 3 options when acquiring an SR-22 certificate from your insurer, Proprietor, Driver, and also Owner-Operator.

Operator - An Operator's SR22 Type is for chauffeurs who obtain or rent a lorry rather than possessing one. This may also be combined with non-owner SR-22 insurance policy and also can supply a less expensive option if it's challenging covering the cost of an SR-22. Operator-Owner - The Operator-Owner's SR22 Form is intended for vehicle drivers who both have an automobile however sometimes, rental fee or obtain an additional automobile.

What Is Sr22 Insurance And What Does It Cover? - The Facts

deductibles deductibles department of motor vehicles car insurance ignition interlock

deductibles deductibles department of motor vehicles car insurance ignition interlock

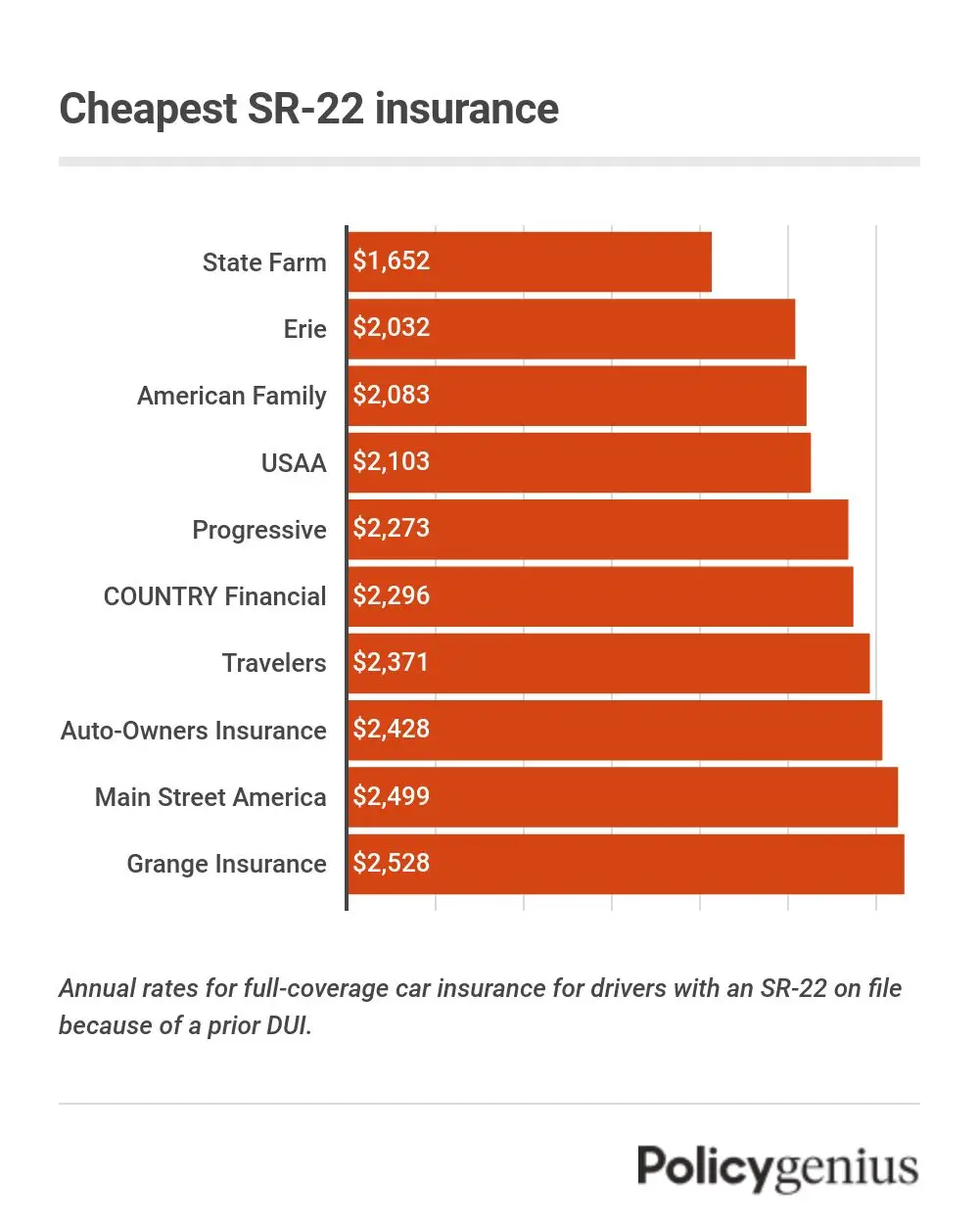

How Can I Locate The Least Expensive SR22 Insurance Coverage Near Me? The best way to discover cheap SR22 insurance policy near you is by going shopping about as well as obtaining quotes.

National insurance firms are not eager to provide protection for somebody who requires SR22 insurance coverage. You may have far better good luck with regional companies as they often will certainly cover high-risk vehicle drivers, which you will certainly be considered with your SR22 demand. Be certain to obtain SR22 quotes from every insurer you encounter and also assess all the SR22 plans offered on the marketplace (insurance coverage).

Does SR-22 Insurance Coverage Cover Any Kind Of Cars And Truck I Drive? Yes, your SR22 insurance coverage will certainly cover any kind of automobile you drive so long as you have owner-operator SR22 insurance. An owner-operator SR22 certificate is a type of SR22 kind that permits you to drive any lorry, no matter of who has it, and still be identified as an insured motorist with a legitimate SR22. sr22.

Proprietor SR22 insurance coverage is an SR22 form that only enables you to drive vehicles that you own. Non-owner SR22 insurance coverage is the cheapest choice yet is only for people that do not have a car yet they often drive, whether it be from renting or borrowing someone else's car - car insurance. It depends on what your vehicle ownership condition is when it comes to whether your SR22 will rollover to vehicles you drive.

DUI convictions are one of the most usual reasons a driver would certainly require SR22 insurance policy. This can include things like reckless driving as well as driving without insurance policy.

The Only Guide to What Does A Sr22 Insurance Cover? Chicago Sr22 - Urban ...

They will submit your SR22 for you with the state. If your insurance coverage company does not use SR22 certificates, you will certainly require to discover a supplier that does and acquisition insurance policy coverage via them to file the SR22 form efficiently. Keep in mind that filing an SR22 kind will certainly not be the only point required of you following a DUI.

coverage department of motor vehicles insurance auto insurance sr22 insurance

coverage department of motor vehicles insurance auto insurance sr22 insurance

What's The Distinction Between Responsibility Insurance Policy As Well As SR22 Insurance Coverage? It's tough to compare Responsibility insurance policy and also SR22 insurance as one does not actually supply you with insurance coverage.

Your car insurance coverage firm will fill in the appropriate SR22 paperwork as well as file it with your state's Division of Electric motor Vehicles or DMV. Acquiring this SR22 certification does not give you with insurance policy coverage. An SR22 only notifies the state that you have auto insurance coverage as well as can spend for problems must you trigger a collision - sr-22.

There are 2 types of vehicle insurance coverage: obligation insurance coverage as well as complete protection. Obligation insurance coverage just gives you with the insurance needed by the state. Full coverage vehicle insurance policy expands security by including collision and detailed protection on top of obligation insurance.

By purchasing at least one of the outlined insurance policy policies, you can get SR22 insurance policy. Yes, the only method SR22 insurance as well as SR22 certificates differ are their names.

Our What Is Sr22 Insurance? - Lemonade Statements

Referring to it as an SR22 certification is a lot closer to its actual feature. An SR22 works as a certification of monetary obligation that verifies to the state that you are fulfilling the insurance needs mandated for all motorists. SR22 insurance policy likely got its name due to the fact that the SR22 form can just be submitted with your car insurer, as well as offers as evidence that you are carrying the appropriate insurance coverage.